GDV and the impact COVID-19 is having on valuations: LinkedIn poll results and Maslow’s view

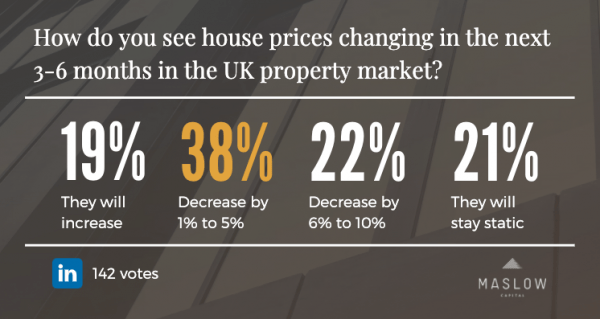

During a recent webinar discussion hosted by International Hospitality Media, I joined a panel of industry experts to discuss a number of pressing topics currently facing the property sector. During the discussion, we focussed on GDV and the impact COVID-19 is having on valuations in the short to medium term. To that end, we decided to put the topic to our followers and connections on LinkedIn by conducting an interactive poll. We asked our audience how they saw “house prices changing in the next 3-6 months in the UK property market”. The results, which are presented below, make for an interesting read with a ‘Decrease of 1% to 5%’ receiving the most votes, with a 38% share.

The Sunday Times reported this morning that house prices are set to fall by almost 14 per cent once the government’s temporary cut in stamp duty ends and the economic impact of COVID-19 filters through to the property market. With that said, Zoopla research suggests that a major decline in house prices is “unlikely” this year despite the recession and finds that demand from buyers is 34% higher than a year ago, with activity running at its strongest pace for over five years. Figures from the Nationwide Building Society this month showed house prices rising at their fastest pace in 16 years, rising 1.7% in July.

Is this pent-up demand driven by people reassessing how they wish to live in a post COVID-19 world? Evidence has shown that consumer spending has rebounded despite unemployment rising. ONS has now recorded two quarters of GDP falls, putting the UK officially in recession. Savills UK Market update for August suggests that completion numbers have increased sharply, with completion transaction levels in June standing at 64% higher than the same period last year. Can this last? It’s expected that towards the end of the year we will see unemployment rise along with a renewal of Brexit uncertainty.

I do believe it’s possible that part of this very unexpected housing boom has been encouraged by lockdown itself and by the prospect of lasting changes in working arrangements. For example, who would not prefer working from home over a lengthy commute on a packed train to London? Some of Maslow’s more regional developer clients have cited a 50% increase in enquiries for houses with gardens in suburban areas. Rightmove announced increased traffic on their website over lockdown, but for a housing boom to continue it will depend on mortgage availability, some lenders are making life tougher for first time buyers. Mortgage rates have increased on high loan-to-value mortgages despite the Bank of England cutting official interest rates to a record low of just 0.1%.

Development finance by its very nature requires forward thinking as there are many moving parts compared to completed assets. Development lenders have to manage construction risk, ensuring the product is delivered to the right specification for that micro market whilst navigating the uncertainties of end values once the project hits PC. This has led to many development funders taking a more cautious approach to their lending appetite in the face of what could be a challenging market over the next 12 months. As ever, Maslow continues to focus its attention on supporting experienced developers and contractors who are delivering schemes that demonstrate sound affordability in areas with attractive supply and demand characteristics.

This consistent approach has led to Maslow supporting the development of over 11,744 units with a collective GDV exceeding €3.6 billion over the past 10 years and we fully intend to substantially increase this over the next 10 years.